how to pay income tax malaysia

1 Tax Payment Through FPX Services This service enables tax payment through FPX Financial Process Exchange gateway. If your chargeable Income is RM53000 you will pay RM1800 420 RM2220 as income tax.

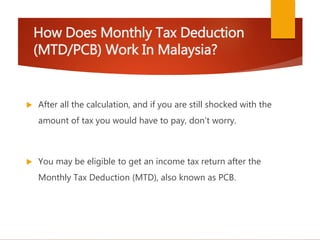

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

You can claim deductions on expenses related to the transactions as well as other expenses based on the general deduction rules.

. Then if you qualify for any of the tax exemptions and reliefs those amounts will be deducted from your. Taxpayers can make payments of income tax and real property gains tax using a credit card online at httpsbyrhasilhasilgovmycreditcard These services can be used for all. Income Tax Payment other than instalment.

If you dont meet the taxable threshold after-tax deduction the system will show 0 in the payable amount. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. As of writing the Malaysian.

Verify your tax information. Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting On the First 5000 Next 15000. The non-resident tax rate in Malaysia is.

Firstly the total of all your incomes in the whole tax year will be added. This is a form of. Taxpayers with business income The assessment shall be made between CP500 instalment and tax payable.

First verify your personal details. At the time of writing personal income tax for Malaysian tax residents is progressive from 1 - 30 depending on income level. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia.

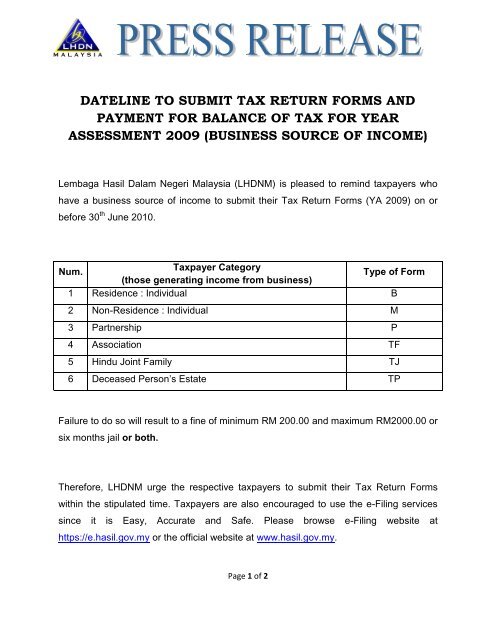

If the instalment amount CP500 is insufficient the amount difference must be. Tax Monthly Instalment Payment Balance of Tax - Company. Income tax payments can be made online on the LHDN site via online banking and credit cards.

This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. Up to RM3000 for. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

Thats a difference of. According to Lembaga Hasil Dalam Negeri LHDN also known as the Inland Revenue Boardthose earning at least RM34000 a year after EPF deductions need to pay. Your total income will then be calculated and.

Additionally payments can also be made through over the counter services at. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly. In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you should be filing.

There are many methods to pay income tax payment in Malaysia. Pay income tax by online banking account FPX Pay income tax by credit card Pay income tax by cheque deposit. First RM50000 RM1800 Excess RM53000-50000 RM3000 Percentage on.

Investigation Composite Advance and Instalment Payment. A user taxpayer is required an internet banking account with the. This enables you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585.

Our calculation assumes your salary is the same for 2020 and 2021.

Solved Income Tax Act 1967 Stated About A Foreign Worker Or Chegg Com

First Time Taxpayer Registration Guide Income Tax Malaysia 2022 Youtube

Personal Income Tax 2016 Guide Part 7

Dateline To Submit Tax Return Forms And Payment For Balance Of Tax For

Malaysia Personal Income Tax Relief 2021

Income Tax Malaysia 2022 Who Pays And How Much

How To Calculate Foreigner S Income Tax In China China Admissions

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

A Malaysian S Last Minute Guide To Filing Your Taxes

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Rates 2022

Withholding Tax On Foreign Service Providers In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To File Income Tax For The First Time

Malaysia Personal Income Tax 2021 Major Changes Youtube

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

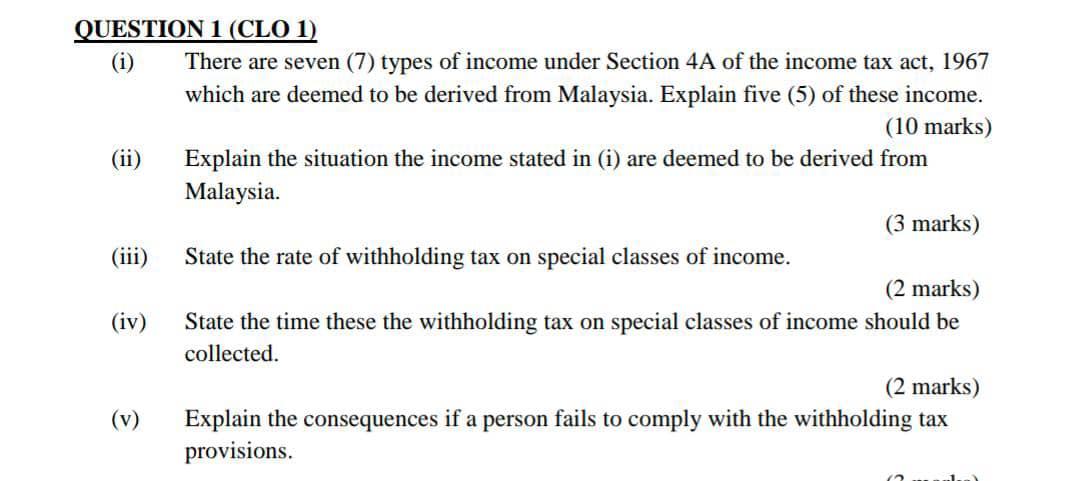

Solved Question 1 Clo 1 There Are Seven 7 Types Of Chegg Com

Comments

Post a Comment